The Trend Is Your Friend !

— a performative and interactive artistic experiment

Idea, Concept, Artwork, Installation: Sylvia Eckermann.

Concept, Artistic Research, Text: Gerald Nestler. Composition: Peter Szely

• MedienKunstLabor | KUNSTHAUS GRAZ 26/9 - 8/11 2009

The Trend is your Friend!

is an artistic and experimental translation of the market as a model that increasingly interferes with our social environment. The installation takes a close look at economic trends that relate to finance, commodities, fashion, media, consumption, and many other spheres of life.

TIYF! is a machine that is constructed from visuals and sound, invites the visitors to participate, and is triggered by robots. The work questions the economic world and the market place—this persistent environment that surrounds us. It asks: How can we influence this environment and what is our role in the "game"?

The machine we created is an independent self-supporting system; human beings do not necessarily have to get involved in order to keep it running. The visitors can choose between observing and enjoying the audiovisual presentation or actually participating actively: In the latter case they—in the true sense of the word—slip into the role of traders trying to force the market movement in their favour. Thus, they participate in the formation of trends without being in the position to manipulate the system on their own.

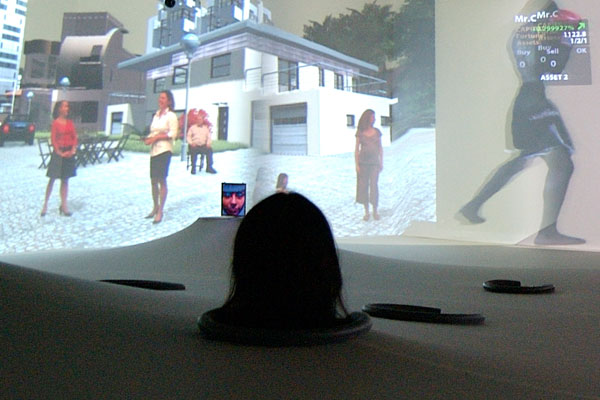

The Installation

To find out and engage in this experiment, we are invited to participate: We enter the interactive installation (by sticking our heads through the architecture from below) and are immersed in a virtual world. We see digital video scenarios (270° projection) around us that constitute the assets of a market game in which we trade by ordering with our heads as joysticks. We sell or buy aesthetic and social values and we bet capital on the scenarios/assets' performances and appearances. All our trades flow into code, which is based on a market model. Our mutual activities instantly result in market prices, which translate into visual and acoustic changes of the respective scenario. What happens around us is the result of our collective, but not necessarily shared behaviours and desires. Not only do we influence, but also move markets, and thus create, inflate and deflate trends. If the majority of players get too hyped up in one direction, we see a bubble bursting.

Robot traders are the "market makers" on this artistic trading floor. They ensure activity and at the same time create a "real-world scenario:" The contingency resulting from their random behaviours prevents the market from being manipulated by potential joint actions of human traders. Inside this world, we 'invest' capital, win or lose 'money' and we see exactly how much we trade on each asset. Even when we leave this world, the game isn't over: Our successors inherit our capital. When our place is not filled, inflation slowly decreases the capital's value.

The Body and Mind Split

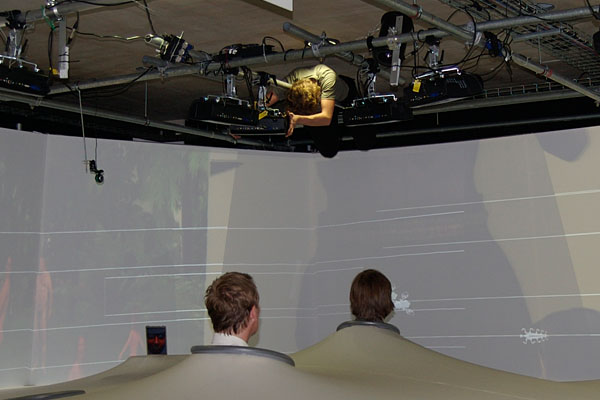

Stretched horizontally across the exhibition space, an inserted ceiling forms a second level. It resembles a stock chart unfolding into 3D space. This membrane separates the real from the virtual space of the exhibition. The lower section, "the real space", is visible from the outside: The passers-by see headless people whose body movements are due to "another" reality—the immersive virtuality of the exchange floor.

The visitors enter the installation by slipping underneath the architecture to find an opening in the membrane. They stick their heads through and become part of the media-architectural environment—"the virtual space". Their heads become "joysticks", and with this interface as well as their voices they communicate in the world of TIYF!

Anonymisation

12 players are allowed to participate at the same time. 7 are human, while the other 5 are robots. The robots' main tasks are to serve as market makers and to allow for a real world situation that can't be manipulated by human players.

Interaction

Each he participant/trader's head movements are tracked. A virtual insect is assigned to each participant/trader. When she looks around, the insect follows her eyes.

When the participant/trader stops moving her head and looks at the screen, the insect turns into an info display which shows the following information: name (Ms.A, Mr.B...), capital and asset shares of the user as well as the bid and ask prices for selected assets.

Asset Selection

The scenario/asset the trader looks is automatically selected. When the trader shouts, "buy" or "sell", the selected asset and the ask or bid-offer are indicated on the info display.

Price Determination

The system works like an open outcry trading floor, except that the frequency of shouts decides the price—the more often the trader shouts "buy" or "sell", the higher the ask, the lower the bid, respectively.

Trend and Bubble

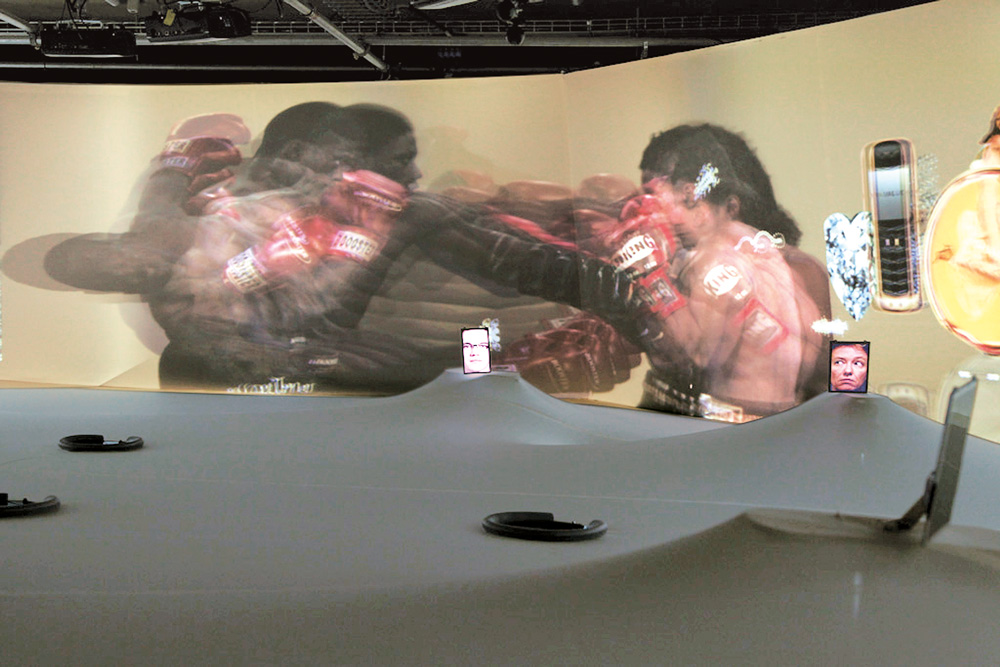

A trend is created when a critical mass of traders decides for trades on the same preference. The more this preference is accepted, the higher the probability that the trend formation develops into a bubble, which culminates in a burst and a subsequent market crash. When a bubble appears, the respective scenario starts to extend across the whole projection screen, shrinking the other asset worlds. The sound and visuals of the bubble overlap and dominate the whole trading floor. After the burst and crash, the scenarios again appear trisected, with the crashed asset showing a clip that corresponds to a stabilised position and market value.

The Scenarios / Assets

A 270° projection screen of 20 by 2 metres shows the virtual "trading floor". It is comprised of three different scenarios that also constitute the assets in our trading game. The scenarios are derived and created from videos, images, 3D environments, texts and sound. They constitute a set of value preferences that the visitors are invited to choose from by trading in line with their personal inclinations and motives. The audiovisual content of each scenario is composed of 25 video clips — discrete asset material. The two poles of each sequence (Clips 1+25) correspond with bursting bubbles. A bar chart at the upper corner of each projection field shows the history of trades already processed.

The following brief description of the clips gives the content as a whole including the poles. In reality, the visitors enter and find for each scenario a specific clip at some point of the spectrum. A successive development of the markets is just as unlikely as in a real market; the video content appears more or less volatile. Only in the case of a forming trend a clear direction is more likely to appear.

Credits

Idea, Concept, Artwork, Installation: Sylvia Eckermann.

Concept, Artistic Research, Text: Gerald Nestler. Composition: Peter Szely

• MedienKunstLabor | KUNSTHAUS GRAZ 26/9 - 8/11 2009

System architecture: Winfried Ritsch,

Pd/Game programming: Marius Schebella,

GEM Render Library Programming: Johannes Zmölnig,

Robotics: Florian Krebs,

Display Environment/ Team TU, Graz: Markus Murschitz/ Christian Pirchheim/

Univ. Prof. Dieter Schmalstieg/ Manuela Waldner,

Architecture: Andreas Baumgartner/ Christina Romirer,

Arch. Assistant: Florian Stöffelmayr,

Additional 3D-Animation: Josef Wienerroither,

Insects animation: Fatih Aydogdu,

Camera: Hans Kraxner/ Cosimo Hnilicka,

Photo and video documentation: Martin Krusche,

Market model: Wolfgang Höchtl.

Production MedienKunstLabor: Winfried Ritsch,

Curated by: Mirjana Peitler.

In co-operation with

steirischer herbst 09,

The Institute for Computer Graphics and Vision (TUG),

The Institute of Electronic Music and Acoustics (KUG)

We would like to thank all the participants who helped make this project possible:

Ndombi Kande/ Ammed Omar Osman/

Alois Bernsteiner/ Amelie Bernsteiner/ Anita Bernsteiner/ Jon Eckermann/

Gerald Fischer-Bernsteiner/ Fanny Haider/ Anna K. Hofbauer/ Barbara Imhof/

Oliver Irschitz/ Regina Leibetseder-Löw/ Renate Schwabl/

Noemie Ballof/ Ursula Endlicher/ Robert Fink/ Hanna Resch/ Axel Stockburger/

Christoph Gsottbauer/ Michael Kuhn/ Vesna Tusek.

Special thanks go to:

Markus Bauer, City-Thong Vienna,

Prof. Romuald Bertl and Martina Haas.

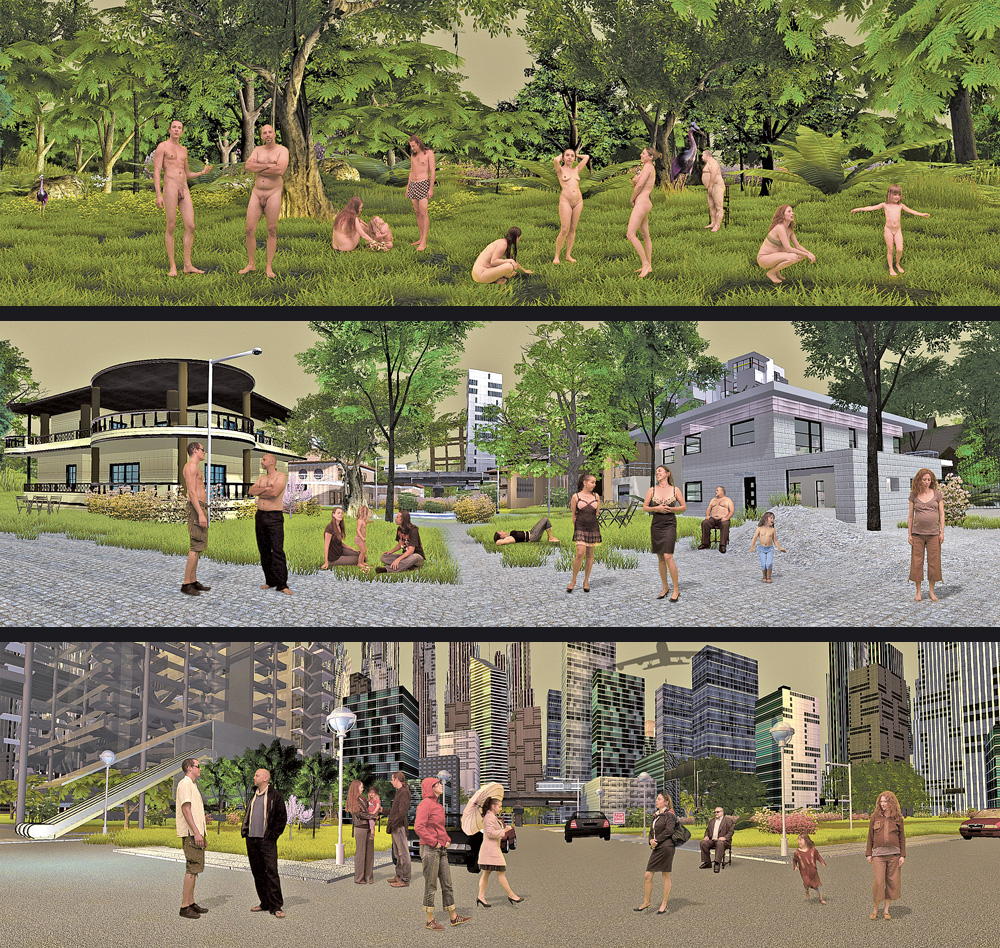

Scenario 1 UTOPIA

As applies to all 3 scenarios, the traders' buy/sell behaviours affect the condition of the "tableau vivant"—here, the appearance of a heterogeneous group of people and their environment. Clip 1 shows the members of the group naked in a primordial, jungle-like landscape reminiscent of traditional depictions of Eden. A purchasing behaviour affects a gradual shift towards a more modern, civilised demeanour and surrounding. At the other end, clip 25, the scenario shows a modern utopia with a postmodern downtown and suburbia lurking in the background. Everyone is well-dressed.

Scenario 2 COMBAT

Two people fight. The video image, rich in detail, depicts the procedures of this showdown. The more the trades tend to buying behaviour, the more brutal, hectic and wild the fight. When a trend results in a bubble, the fighters don't focus their aggression against each other; the bubble bursts into a reaction against the viewers/traders. A selling behaviour, however, slows the fight down; it more and more resembles a dance, a cautious and delicate interaction. When the trading reaches the other pole, clip 1, the fighters show signs of friendship and social behavior. The bubble bursts into friendliness and joy.

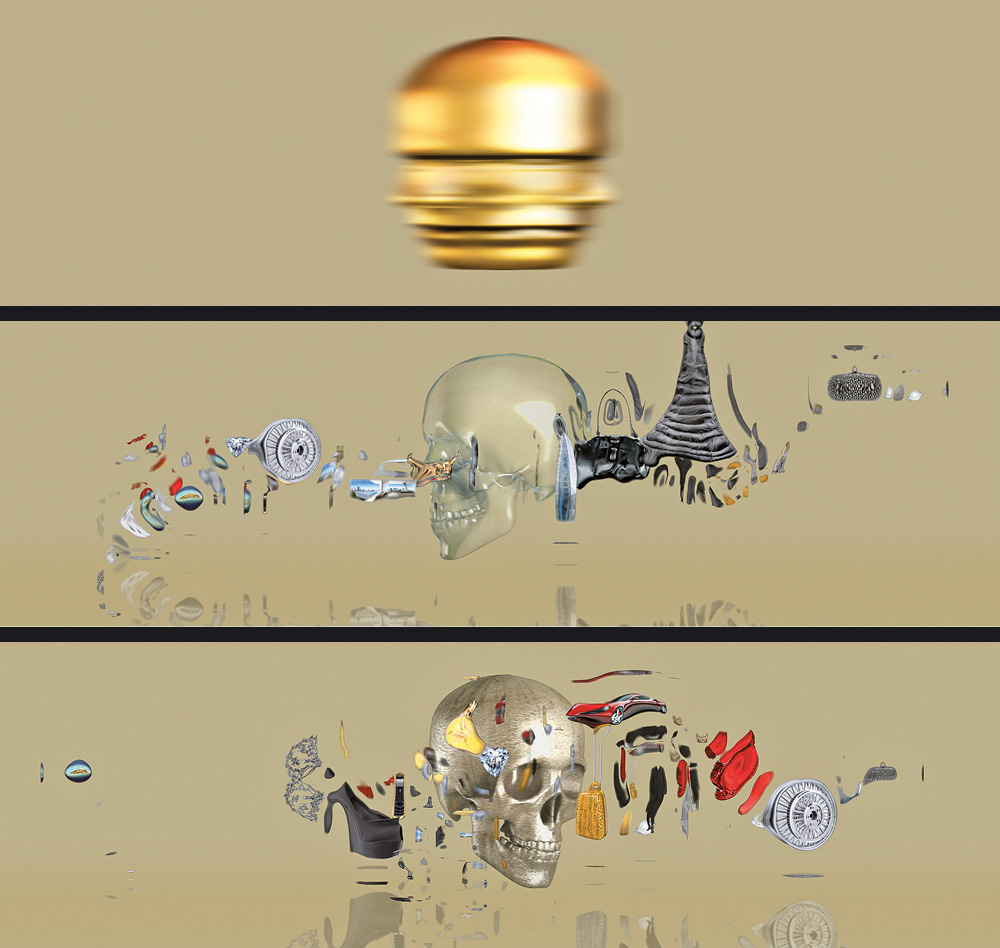

Scenario 3 VALUE

At the centre of the field of view a rotating head appears that changes form and texture according to current value. Artefacts surround the head: They seem far and remote at one pole and moving in circles. The head here is formless, a liquid mass without any attraction. The bubble seems to show plankton inside a liquid void. The more the scenario tends to the other pole, the more the head's attraction builds up with the artefacts starting to orbit the skull. At culmination, a gravitational power draws the artefacts—we are now able to distinguish luxury items and brands—into its own rotation, absorbing each of them. Step by step, the liquid form becomes head-shaped and changes its appearance and texture. The bubble bursts into a golden head. It rotates so fast that it seems to stand still.

The Market Model by Wolfgang Höchtl

The Trend Is Your Friend! examines the behaviours of different actors under artistic and game theoretical aspects. The game tests the players' reactions towards risk, appreciation in value, courage, and indifference. The participants trade with an asymmetrical standard endowment of money and shares. The market model is based on the "double auction" (as formulated by Nobel Laureate Vernon Smith in 1962). In a given time frame of 30 seconds, the traders can emit buy or sell orders. The system allocates the market price from the lowest ask price and the highest bid price. The traders are allowed to trade one share in each period. After clearing the transactions, the portfolios and accounts are updated. Subsequently, the status of the world is determined for the period, and the traders receive a dividend. A new trading period starts. Thus, prices and trade develop and a chart is traced based on the trades.

For more information on the market model, please see the text by Wolfgang Höchtl; ▸ download pdf